The Facts About Guided Wealth Management Uncovered

The Facts About Guided Wealth Management Uncovered

Blog Article

The Facts About Guided Wealth Management Uncovered

Table of ContentsAbout Guided Wealth ManagementGuided Wealth Management Things To Know Before You Get ThisNot known Facts About Guided Wealth ManagementWhat Does Guided Wealth Management Mean?A Biased View of Guided Wealth ManagementAll About Guided Wealth Management

Selecting an effective financial consultant is utmost important. Expert roles can vary depending on numerous variables, including the kind of monetary expert and the customer's needs.For example, independent suggestions is impartial and unlimited, yet limited guidance is limited. A limited expert ought to state the nature of the restriction. If it is vague, more inquiries can be increased. Conferences with clients to discuss their funds, appropriations, needs, earnings, expenditures, and intended goals. financial advisor brisbane. Giving suitable strategies by examining the background, financial data, and capacities of the customer.

Directing clients to execute the monetary strategies. Normal monitoring of the financial profile.

If any issues are come across by the management experts, they sort out the origin and solve them. Develop a financial threat evaluation and examine the potential result of the threat. After the conclusion of the risk evaluation model, the advisor will certainly assess the outcomes and offer a proper service that to be carried out.

The Guided Wealth Management Ideas

They will aid in the success of the economic and personnel objectives. They take the responsibility for the given choice. As a result, clients require not be worried concerning the decision.

However this caused an increase in the web returns, expense savings, and also led the path to profitability. Several steps can be compared to determine a qualified and qualified consultant. Generally, experts need to satisfy standard academic credentials, experiences and certification advised by the government. The basic academic certification of the expert is a bachelor's degree.

Always ensure that the advice you obtain from a consultant is always in your best passion. Eventually, monetary advisors maximize the success of an organization and likewise make it grow and prosper.

Guided Wealth Management Things To Know Before You Get This

Whether you require someone to assist you with your tax obligations or stocks, or retired life and estate planning, or all of the above, you'll locate your solution right here. Keep checking out to learn what the distinction is in between a financial consultant vs planner. Generally, any kind of professional that can assist you handle your cash in some fashion can be thought about an economic advisor.

If your objective is to create a program to meet long-term financial goals, then you most likely want to employ the services of a licensed monetary coordinator. You can look for a coordinator that has a speciality in tax obligations, financial investments, and retired life or estate planning.

A monetary consultant is just a broad term to describe a professional that can help you manage your money. They might broker the sale and purchase of your stocks, manage investments, and help you create a comprehensive tax or estate strategy. It is necessary to keep in mind that an economic expert must hold an AFS permit in order to serve the public.

The 10-Second Trick For Guided Wealth Management

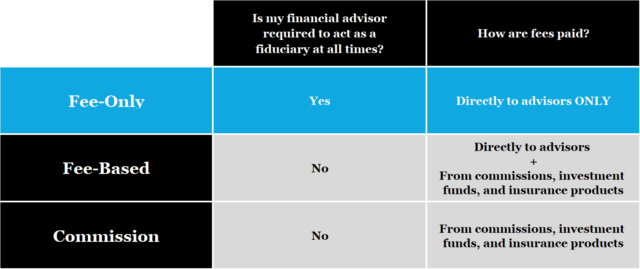

If your financial consultant checklists their services as fee-only, you ought to anticipate a checklist of services that they provide with a malfunction of those fees. These experts don't provide any kind of sales-pitch and usually, the services are cut and completely dry and to the factor. Fee-based experts charge an in advance charge and afterwards gain commission on the financial products you buy from them.

Do a little research first to be sure the monetary expert you work with will certainly have the ability to take care of you in the long-term. The best place to start is to ask for recommendations from household, good friends, associates, and neighbors that remain in a comparable economic scenario as you. Do they have a relied on monetary consultant and exactly how do they like them? Requesting recommendations is a great method to get to know a financial advisor prior to you also fulfill them so you can have a much better idea of exactly how to handle them in advance.

More About Guided Wealth Management

You ought to constantly factor expenses right into your monetary preparation situation. Thoroughly assess the charge frameworks and ask concerns where you have complication or issue. Make your possible advisor respond to these questions to your contentment before moving on. You might be looking for a specialized expert such as someone that concentrates on separation or insurance coverage preparation.

An economic expert will help you with establishing possible and reasonable objectives for your future. This can be either beginning a company, a household, preparing for retired life all of which are essential phases in life that require careful factor to consider. An economic consultant will certainly take their time to review your scenario, short and long-term goals and make recommendations that are ideal for you and/or your household.

A research from Dalbar (2019 ) has actually highlighted that over 20 years, while the average investment return has been around 9%, the average investor was just getting 5%. And the difference, that 400 basis factors annually over twenty years, was driven by the timing of the financial investment choices. Handle your profile Shield your assets estate planning Retirement planning Handle your extremely Tax obligation financial investment and monitoring You will certainly be needed to take a danger tolerance survey to offer your advisor a clearer picture to establish your financial investment property appropriation and choice.

Your consultant will examine whether you are a high, medium or reduced danger taker and set up an asset allocation that fits your threat resistance and capability based on the information you have actually supplied. For instance a high-risk (high return) person may buy shares and building whereas a low-risk (reduced return) individual might desire to purchase cash and term down payments.

Guided Wealth Management - Truths

Therefore, the a lot more you conserve, you can select to spend and build your riches. As soon as you engage a monetary expert, you don't need to handle your portfolio (superannuation advice brisbane). This saves you a great deal of time, initiative and energy. It is necessary to have appropriate insurance plan which can supply comfort for you and your family members.

Having an economic advisor can be extremely helpful for lots of people, yet it is essential to weigh the pros and cons before choosing. In this description short article, we will explore the advantages and drawbacks of dealing with a financial advisor to help you decide if it's the best relocation for you.

Report this page